Introduction

Silvergate financial institution introduced it could start winding down operations and bear voluntary liquidation.

On March 8, the financial institution mentioned it was exploring the way it might resolve claims and make sure the continued residual worth of its asset whereas repaying all deposits to purchasers. The choice was made in mild of “current business and regulatory developments,” its holdings firm Silvergate Capital mentioned.

The announcement got here days after the financial institution introduced it could halt the Silvergate Change Community (SEN), its real-time settlement service. On March 3, Silvergate submitted an SEC submitting stating that it confronted inquiries from the U.S. Division of Justice (DOJ) and would file a late 10-Okay report.

Whereas the financial institution’s troubles culminated on March 8 with the liquidation announcement, it has struggled for a number of months. For the reason that collapse of FTX in November 2022, the financial institution has seen its inventory worth depreciate by over 94%.

Probably the most important 24-hour loss was recorded between March 1 and March 2, when the NASDAQ-listed SI dropped 57%.

The information despatched shockwaves by means of the crypto market, because the U.S. financial institution served because the spine for the crypto market, offering monetary companies to most massive crypto firms and exchanges within the nation.

Bitcoin dropped to its January low of $19,680 after buying and selling flat at round $21,000 for over a month. The whole crypto market cap dipped under $1 trillion, struggling to retain $880 billion at press time.

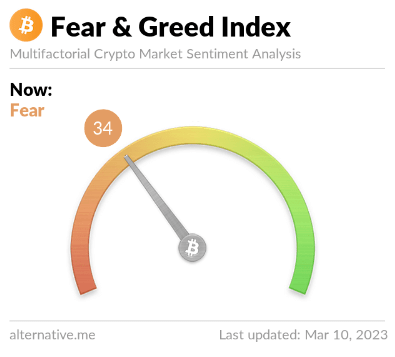

The crypto concern and greed index has steadily decreased and reveals concern. Declining buying and selling volumes and rising change withdrawals present investor sentiment is worsening each day.

Regardless of nonetheless being operational, Silvergate has had a profound impact available on the market. It triggered a domino impact that may have an effect on not solely cryptocurrency firms within the U.S. however the whole banking sector within the nation.

On this report, CryptoSlate dives deep into Silvergate to see what introduced the previous banking big to its knees and the way different banks might share its future.

How Silvergate obtained large

Silvergate was based in 1988 and commenced an initiative to service cryptocurrency purchasers in 2013 after its CEO Alan Lane personally invested in Bitcoin. Additional analysis into cryptocurrencies confirmed that the market was lacking banking companies, a gap Silvergate was the primary and the quickest to fill.

Silvergate’s choice to cease its mortgage operations in 2005 helped it climate the storm attributable to the subprime mortgage meltdown. When the Nice Monetary Disaster hit in 2008, the financial institution was among the many few within the nation who might lend. Nevertheless, the financial institution lacked buyer deposits to fund these loans and was on the lookout for methods to draw new prospects.

The crypto business within the U.S. was crammed with firms with nowhere to go. With Silvergate positioning itself as the only real savior of what can solely be described as a banking disaster in crypto, it noticed its deposits double in a yr. In 2018, it serviced over 250 worldwide purchasers within the crypto area. As of September 2022, Silvergate had 1,677 prospects utilizing SEN.

This was primarily as a result of Silvergate’s modern strategy to servicing the business. As an alternative of simply offering custody companies to crypto purchasers, the financial institution created the Silvergate Change Community (SEN), a real-time settlement service that enabled the seamless stream of {dollars} and euros between crypto firms. The service was revolutionary on the time, as no different financial institution had real-time cost capabilities that will match the 24/7 cost wants of the crypto business.

The financial institution’s companies rapidly grew to accommodate the rising urge for food of the business — it noticed lots of of hundreds of thousands of {dollars} in further investments and commenced offering Bitcoin-collateralized loans to purchasers.

As Silvergate charged no charges to make use of SEN and its buyer deposits didn’t bear any rates of interest, it profited through the use of the deposits to spend money on bonds or problem loans to earn cash on the unfold. A Forbes report from October 2022 confirmed that commitments to SEN Leverage reached $1.5 billion, up from $1.4 billion recorded in June.

This modest development mirrored the comparatively flat deposits the financial institution noticed all through 2022. After its parabolic rise in 2020 and 2021 throughout the bull market, deposits peaked within the first quarter of 2022 because the community turned absolutely saturated.

Silvergate’s fast and painful dying

Then, FTX collapsed and commenced wreaking havoc available on the market. Bitcoin dipped to a two-year low of $15,500, dragging the remainder of the market deep into the crimson. Over $4 billion price of buyer funds on FTX threatened to be misplaced without end, prompting regulators worldwide to maintain a watchful eye on the business.

And whereas Silvergate had no lending relationship with FTX, it failed to stay immune from the fallout.

It started seeing an alarming improve in withdrawals because the fourth quarter started. CryptoSlate’s analysis on the time famous that the market was turning into apprehensive that the contagion from FTX might unfold to Silvergate’s different collectors. The financial institution’s ten greatest depositors, which included Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle, accounted for half of its deposits on the finish of the third quarter.

Silvergate started borrowing in opposition to the long-dated property it held to fight its dwindling deposits, principally U.S. treasuries and company bonds. Nevertheless, it didn’t maintain the market at bay and stop additional withdrawals, forcing it to start promoting the property to pay out its depositors.

With rising rates of interest and dangerously excessive inflation, Silverage reportedly misplaced no less than $700 million on promoting $5.2 million price of bonds within the fourth quarter and took one other $300 million on a fair-value adjustment of its remaining portfolio.

At first of November 2022, Silvergate had $11.9 billion in buyer deposits. By the tip of December 2022, its deposits dropped to $3.8 billion.

The domino impact

Whereas it’d take a number of months for Silvergate to wind down its operations, its impact available on the market is already evident. Market sentiment appears to have sloped to a brand new low, with each retail and institutional traders shedding the little confidence they’d in banking establishments.

Inventory costs for among the different main cryptocurrency banks are starting to point out this.

Signature Financial institution, one other massive U.S. financial institution centered on offering companies to crypto firms, noticed its inventory drop over 34% because the starting of February. SBNY posted a 12% loss between March 7 and March 8. It is a important loss for the financial institution, whose crypto deposits comprise solely 15% of its whole deposits. The financial institution additionally doesn’t have interaction in crypto-backed lending or maintain cryptocurrencies on its purchasers’ behalf. It additionally signed on a number of massive purchasers that left Silvergate, together with LedgerX and Coinbase.

Regardless of Barron’s assessment that Signature remains to be a great purchase, anticipating its inventory to regain its ATH in a comparatively brief timeframe, confidence within the sector is at its all-time low.

After a tumultuous week, Silicon Valley Financial institution was closed on Friday, March 10.

The New York-based financial institution noticed its inventory drop over 62% because the starting of March after shedding 12% in February. Shares of SVB Monetary, the financial institution’s holding firm, adopted Signature’s sample — they peaked in October 2021 on the top of the bull market, posting a 176% YoY development.

The virtually vertical drop within the financial institution’s inventory worth adopted the announcement that the financial institution wanted to lift $2.25 billion in inventory. Broader market turmoil pushed lots of SVB’s startup and tech purchasers to withdraw their deposits, pushing the financial institution to promote “considerably all” of its available-for-sale securities at a $1.8 billion loss.

The financial institution confronted an ideal storm. Shoppers have been pulling their deposits at an alarming price as they feared the domino impact attributable to Silvergate. Its purchasers, made up principally of high-growth startups, are seeing a notable lower in VC funding exercise and a rise in money burn because the market begins to decelerate. Morgan Stanley famous that this was the primary driver for the decline in SVB’s consumer funds and on-balance-sheet deposits, despite the fact that they mentioned the financial institution had “greater than sufficient liquidity” to fund these outflows.

Nevertheless, sources near the financial institution revealed on Friday that the financial institution was reportedly in talks to promote itself as its makes an attempt to lift capital have failed. CNBC reported that “massive monetary establishments” have been trying on the potential buy of SVB.

Then, the California Division of Monetary Safety and Innovation closed SVB on March 10, appointing the FDIC as a receiver. A brand new financial institution was created — the Nationwide Financial institution of Santa Clara — to carry the insured deposits on behalf of SVB’s purchasers. FDIC famous that the financial institution can be operational as of Monday, with all SVB’s insured depositors having full entry to their insured deposits. Because of this purchasers with deposits exceeding $250,000 will obtain a receivership certificates that will allow them to redeem their uninsured funds sooner or later.

Different monetary shares proceed to stumble. Spooked by SVB’s securities sell-off and its subsequent shutdown, traders started dumping shares of different massive banks within the U.S. The 4 greatest banks within the U.S. — JPMorgan, Financial institution of America, Wells Fargo, and Citigroup, misplaced $54 billion in market worth on Thursday, March 9.

JPMorgan suffered probably the most important loss, seeing its market cap drop by round $22 billion. Financial institution of America adopted with a $16 billion loss, whereas Wells Fargo’s market cap was down $10 billion. Citigroup posted a $4 billion loss.

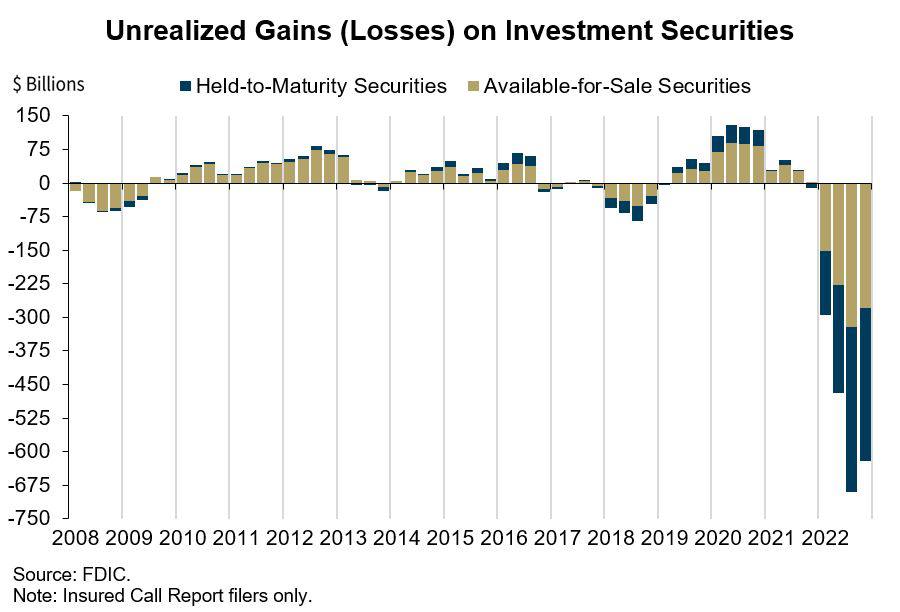

Not one of the massive legacy banks within the U.S. have up to now been confronted with deposit withdrawals like those Silvergate and SVB skilled. Nonetheless, traders appear frightened that the banks received’t have the ability to meet the outflow demand, as most maintain massive quantities of long-term maturity property. Acquired when rates of interest have been traditionally low, these securities are price considerably lower than their face values. The Federal Deposit Insurance coverage Company (FDIC) estimated that U.S. banks held round $620 billion in unrealized losses on these securities on the finish of 2022.

The contagion from Silvergate has unfold to Europe as effectively.

Credit score Suisse, one of many largest banks in Europe, noticed its shares drop to their all-time low on Friday, March 10, main different European banking shares down with it.

And whereas the loss Europe’s STOXX banking index noticed was simply 4.2%, it nonetheless represents the largest one-day slide since June 2022. Different main banks within the E.U. additionally noticed important losses, with HSBC posting a 4.5% loss and Deutsche Financial institution dropping 7.8%.

Regulatory blowback

The collapse of FTX triggered an unprecedented regulatory crackdown on the crypto business. This has been most obvious within the U.S., the place lawmakers have been preventing a vicious struggle over how one can regulate the booming market.

The collapse of FTX solely added gasoline to the fireplace, creating an aggressive new motion that set its sights on tightening its reigns on the business.

Earlier this week, Sen. Elizabeth Warren mentioned that Silvergate’s failure was disappointing however predictable:

“I warned of Silvergate’s dangerous, if not unlawful, exercise — and recognized extreme due diligence failures. Now prospects have to be made entire, and regulators ought to step up in opposition to crypto danger.”

Warren’s criticism wasn’t met with approval, although. Except for the commonly destructive market response, 4 Republican senators despatched a letter to the Board of Governors of the Federal Reserve condemning the elevated regulatory stress.

Within the letter, they acknowledged that the organized try and de-bank the crypto business was “disturbingly reminiscent” of Operation Choke Level. They referred to as for the Federal Reserve, FDIC, and OCC to not punish the whole crypto business because the overreaching conduct of banking regulators will inevitably bleed into different industries.

On March 10, U.S. Treasury Secretary Janet Yellen met with officers from the Federal Reserve, FDIC, and OCC to debate the scenario concerning SVB. Later that day, whereas testifying earlier than a Home Methods and Means Committee listening to, she mentioned that U.S. regulators have been monitoring a number of banks affected by current developments.

Conclusion

It took over 4 months of market turmoil to carry Silvergate to its knees. Nevertheless, the domino impact it triggered led to exponentially sooner deaths for different establishments in line behind it.

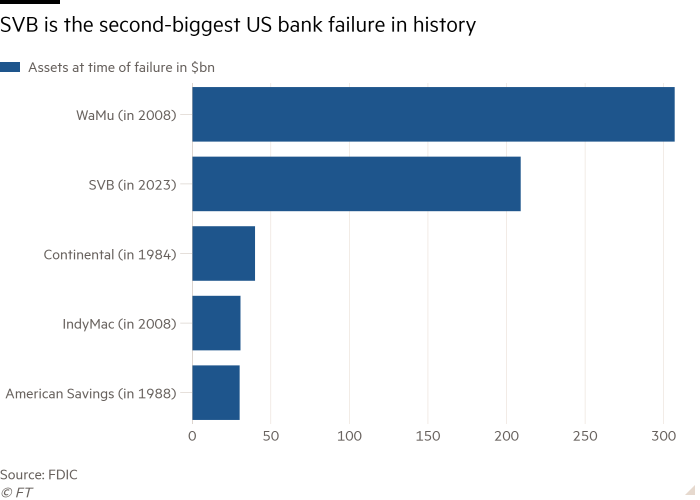

Silicon Valley Financial institution closed down after lower than per week of hypothesis about its solvency. It took hours to turn out to be a poster baby for the crypto banking disaster — SVB is now the second-biggest financial institution failure within the U.S. ever recorded.

Nevertheless, the domino impact that started with Silvergate hasn’t ended with Silicon Valley Financial institution. The total scope of the blowback is but to be felt as each banks will take months to wind down their operations.

Within the meantime, financial institution runs are set to threaten much more monetary establishments servicing the crypto and tech industries. We will count on different small to mid-size banks to battle with paying out buyer deposits.

The crypto banking sector’s unlucky however most probably future might be aggressive centralization and corporatization. As increasingly more boutique banks shut down, massive crypto firms and exchanges will flock to massive legacy banks. Small crypto firms will proceed to battle securing banking companies, resulting in mass relocations or cheaper acquisitions by bigger opponents.