In 2023, there have already been three important financial institution failures within the banking trade. The present banking disaster has destabilized the entire monetary sector.

On March 15, when its largest shareholder, the Saudi Nationwide Financial institution, declined to provide the corporate additional monetary assist, shares of Credit score Suisse fell to a brand new document low. In accordance with studies, Credit score Suisse Financial institution has additionally requested the Swiss Nationwide Financial institution for a public show of assist amid the upheaval.

Additionally learn: Ethereum-Based Uniswap Officially Launches on BNB Chain

Nevertheless, one key factor that needs to be observed is that the costs of cryptocurrencies have been on an uphill development regardless of all of the chaos. In accordance with the most recent knowledge, the king of meme cash, Dogecoin, has surpassed Credit score Suisse in market cap.

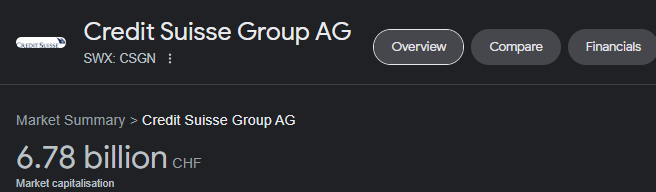

Dogecoin market cap is now larger than that of Credit score Suisse

In accordance with CoinMarketCap knowledge, the market cap of Dogecoin was $9.1 billion at press time. Nevertheless, the most recent knowledge reveals that the market cap of Credit score Suisse has fallen to six.78 billion CHF ($7.3 billion). The second is devastating for the financial institution; nonetheless, it’s a notable second for the Dogecoin neighborhood.

Additionally learn: Credit Suisse Appeals to Swiss Central Bank for Public Backing

The cryptocurrency market has been on a bullish rally during the last two days regardless of the banking turmoil. Nevertheless, the costs of main cryptocurrencies have fallen, because the market is buying and selling within the pink. Regardless of the monetary chaos, cryptocurrencies proved to be extra secure and have been up and operating when the banks have been down.