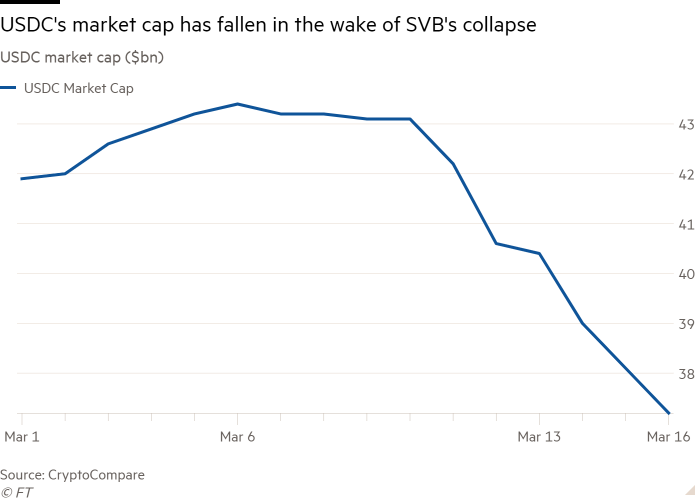

Merchants have withdrawn a internet $3bn from the crypto stablecoin USDC within the final three days because the fallout from the failure of Silicon Valley Financial institution spreads into the digital asset market.

In a weblog put up late on Wednesday, Circle, the operator of USDC, mentioned it had cleared “considerably all” of the backlog of minting and redemption requests referring to USDC in current days. A complete of $3.8bn of tokens had been redeemed by traders because the weekend, and it had minted $0.8bn of latest cash, it added.

The withdrawals, which symbolize nearly 10 per cent of the stablecoin’s complete circulating provide, got here after US-based Circle mentioned it had $3.3bn trapped at SVB. The financial institution was one of many major US banks utilized by crypto firms because the conduit between crypto and sovereign cash, for custody of Circle’s deposits.

Circle’s USD Coin is likely one of the linchpins of buying and selling in digital asset markets. A stablecoin helps join conventional and crypto markets and merchants use them like money or a retailer of worth between crypto trades. USDC sometimes tracks the worth of the greenback one-for-one however traded as little as 88 cents after Circle admitted its publicity to SVB.

Its worth rallied and it regained its greenback peg after US authorities moved to ascertain a rescue bundle for SVB’s depositors, not directly boosting confidence in crypto markets. Chief government Jeremy Allaire additionally mentioned Circle would “stand behind” the token, and canopy any shortfall utilizing company sources, together with exterior capital if crucial.

“The choice by US regulators to repay Silicon Valley Financial institution’s unsecured deposits in full allowed the USDC worth to get better,” mentioned Cristiano Ventricelli, an analyst at Moody’s, the credit standing company. “In any other case, USDC may have suffered from a run and been compelled to liquidate its property.”

Circle has rushed to maneuver the remainder of the money deposits for its reserves to different banks as jitters unfold by means of the banking sector.

Of the $9.7bn in money, $3.3bn was at SVB. Final week, Circle moved $5.4bn to US custody financial institution BNY Mellon. An additional $1bn was held with Prospects Financial institution, a small Pennsylvania-based financial institution. Shares in Prospects have dropped by a fifth previously week amid nervousness within the US banking sector.

“I perceive the flight to scale, it’s the concept that these banks are too large to fail, and if one thing goes unsuitable the US authorities will stand behind them,” mentioned Varun Paul, director of market infrastructure at blockchain platform Fireblocks, who beforehand spent 14 years on the Financial institution of England. “Which will find yourself being true, it’s simply not a really perfect scenario.”

An individual accustomed to the matter mentioned the corporate was “comfy” having moved nearly all of its money reserves to BNY Mellon “for the foreseeable future”.

SVB’s collapse additionally adopted the demise of two different crypto-friendly banks in Signature and Silvergate, representing a blow to the business’s already-thin entry to the established banking system.

“It may have ended up a lot worse than it did, some costs have bounced again however this simply exhibits how the second-largest stablecoin is just not secure, and that’s very ironic,” mentioned Larisa Yarovaya, deputy head of the Centre for Digital Finance at Southampton Enterprise Faculty.