Decentralized finance (DeFi) innovator MakerDAO has launched a brand new lending and borrowing system referred to as Spark Protocol.

On Could 8, DeFi pioneer MakerDAO introduced that Spark Protocol could be launched on Could 9.

The platform was described as an end-user, DAI-centered DeFi product deployed on Ethereum. It options provide and borrow functionalities for ETH, stETH (Lido staked ETH), DAI, and sDAI.

The protocol’s first product is Spark Lend. {The marketplace} has a deal with lending and borrowing crypto utilizing DAI, Maker’s native stablecoin.

MakerDAO tweeted, stating:

“Customers will be capable of work together with Spark’s front-end immediately, connecting Maker’s liquidity with an entire DeFi answer.”

MakerDAO Deal with Stability

Moreover, Spark Lend introduces a tokenized model of DAI deposited within the DSR (DAI Financial savings Fee) referred to as sDAI. Nonetheless, yields are woefully low in the intervening time, with simply 1.1% on supply for DAI deposits.

Spark can be related to Maker’s D3M. This liquidity balancing system makes use of DAI to maintain liquidity in Spark Lend.

Moreover, it makes use of a Peg Stability Module (PSM) that connects the liquidity infrastructure for immediate swapping of DAI and sDAI for USDC.

The yields could also be low, however DeFi users have grown cautious of unsustainable yield guarantees and excessive danger. Subsequently, stability, liquidity, and decrease dangers have change into the way in which ahead for Maker.

Spark Protocol is a part of MakerDAO’s Endgame plan. The protocol has proposed to make DAI a free-floating asset, initially collateralized by real-world assets (RWA).

Below the Endgame plan, DAI will stay pegged to the greenback for 3 years. Maker plans to build up as a lot Ethereum (ETH) as potential to finally improve the ratio of decentralized collateral.

DAI is at present the fourth largest stablecoin, with a circulating provide of $4.7 billion. This offers it a market share of three.6%, making it the business’s largest decentralized stablecoin. Moreover, DAI provide has declined by 53% since its peak of just about $10 billion in February 2022.

MKR Value Outlook

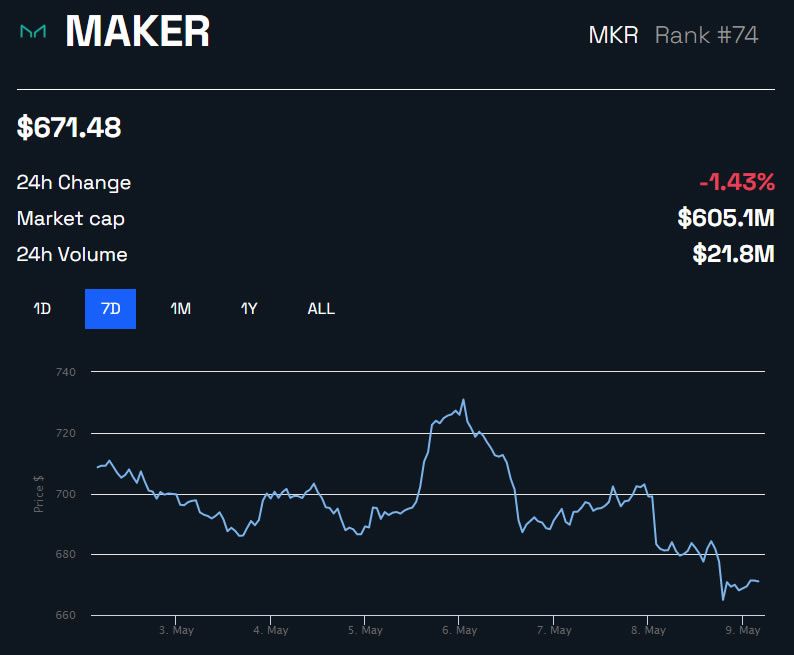

MakerDAO’s native token has dropped round 2% on the day in a fall to $671 as crypto markets retreat. MKR is at present buying and selling at its lowest degree for simply over a month.

The DeFi governance token is down 89% from its Could 2021 all-time excessive of $6,292. Nonetheless, there are solely simply over 900,000 MKR in circulation.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material.