The crypto market has grow to be aggressive, and the battle for supremacy will not be restricted to only Bitcoin and Ethereum. A much less risky however equally vital conflict is being waged within the realm of stablecoins, particularly between Tether (USDT) and USD Coin (USDC). Because the crypto market continues to mature and entice mainstream consideration, the function of stablecoins has grow to be more and more essential. These digital belongings pegged to conventional fiat currencies, supply a refuge from the infamous volatility of the crypto market, offering stability and predictability. Among the many plethora of stablecoins out there, USDT and USDC have emerged because the dominant gamers.

Nonetheless, selecting between these two giants will not be a simple process. Every comes with its personal set of options, advantages, and potential drawbacks. This text goals to delve into the intricacies of USDT and USDC, evaluating their operations, transparency, liquidity, and total trustworthiness. As we navigate by the advanced panorama of those main stablecoins, we goal to give you a complete understanding, serving to you make an knowledgeable determination on which stablecoin will reign supreme in 2023.

What are Stablecoins?

Within the stablecoin market, no battle rages tougher than the colossal battle of USDT vs USDC. Stablecoins are broadly thought-about essentially the most helpful utility of DeFi and blockchain expertise. Whereas so many USD stablecoins exist, Tether (USDT) and USD Coin (USDC) are gentle years forward of the group.

Stablecoins are a type of cryptocurrency pegged to the worth of different belongings like fiat currencies or gold. The most typical stablecoins within the crypto market are pegged to US {dollars} or just USD stablecoins, though new cash pegged to different fiat currencies like EURO and RMB are slowly rising. These crypto belongings stay on the blockchain, offering a considerably secure refuge from the market’s iconic volatility. In an ideal world, these digital belongings are designed to keep up a secure worth no matter fluctuations within the crypto market.

How do Stablecoins Work?

Relying on how they’re created and issued, stablecoins could be each centralized or decentralized. Most blockchain-based stablecoins fall into certainly one of three distinct classes: fiat-backed stablecoins, collateralized stablecoins, and algorithmic stablecoins.

Fiat-backed stablecoins are supported by their corresponding fiat foreign money reserves. Cash are backed 1:1 with an equal quantity of fiat, which the issuer holds in reserve. USDT, USDC, and Binance USD (BUSD) are all glorious examples of fiat-backed cryptocurrencies.

Collateralized stablecoins are backed by different belongings that aren’t fiat foreign money, like Bitcoin (BTC) or conventional belongings like gold. As an alternative of offering fiat in change for stablecoins, customers lock exterior belongings into issuer protocols to mint the corresponding worth in stablecoins.

Algorithmic stablecoins are cryptocurrencies that keep a secure worth by good contracts. These blockchain-based contracts routinely purchase and promote reserve currencies to make sure that cash keep at their meant worth.

What are Tether (USDT) Stablecoins?

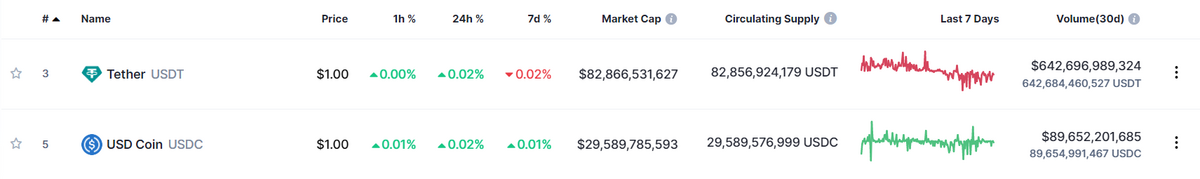

Tether (USDT), a number one stablecoin with a staggering market capitalization exceeding $83 billion, is a product of iFinex, a Hong Kong-based agency that additionally operates the BitFinex cryptocurrency change.

USDT maintains a 1:1 peg with the U.S. greenback, with every token underpinned by belongings held in reserve. This backing permits USDT to operate equally to conventional fiat currencies, enabling spending, transfers, and exchanges.

As one of many pioneering cryptocurrencies, Tether has efficiently addressed a number of blockchain-related hurdles, corresponding to enabling the switch of nationwide currencies and offering a mechanism for customers to confirm the token’s worth.

Regardless of going through criticism over its reserve administration and diploma of decentralization, USDT continues to carry a distinguished place within the stablecoin market. It’s broadly accepted throughout quite a few exchanges and is suitable with quite a lot of wallets.

In response to issues about its stability, the corporate behind Tether has taken steps in direction of higher transparency. It now discloses its money reserves by month-to-month transparency experiences, demonstrating a dedication to addressing person issues.

Controversies On USDT Token

Tether’s journey within the blockchain ecosystem has been marked by a collection of controversies. From the onset, Tether has been beneath scrutiny for its lack of ability to conclusively exhibit that its fiat reserves adequately again the circulating provide of USDT tokens.

The issues escalated when monetary regulators and legislation enforcement companies initiated investigations into Tether, revealing that the reserves weren’t solely inadequate however had been additionally propped up by company loans and unhealthy debt.

Including to the controversy, Bitfinex, a sister firm of Tether, was discovered to have mismanaged $850 million of shopper and company funds, resorting to utilizing Tether’s reserves to steadiness their books. This vital mortgage was stored hidden from buyers by Tether Restricted. In 2021, Tether acknowledged its missteps and paid an $18 million superb.

Whereas these incidents characterize only a fraction of Tether’s advanced historical past, the stablecoin big appears to be charting a brand new course. Tether has proven a renewed dedication to transparency, offering each day updates on the standing of its reserves.

What’s USD Coin (USDC)?

USD Coin, akin to its predecessor Tether, is a stablecoin underpinned by fiat foreign money and maintains a 1:1 peg with the US greenback. The Centre Consortium, a collaboration of respected firms, together with Circle and Coinbase, launched USDC in 2018 as an ERC-20 token on the Ethereum blockchain.

Contrasted with Tether, USD Coin has persistently upheld a commendable fame, demonstrating clear proof of its money reserves. The change of USDC tokens happens on a 1:1 foundation by regulated monetary establishments, offering an extra layer of belief in comparison with Tether’s single-company mannequin.

To additional bolster its credibility, USD Coin publishes month-to-month attestations and undergoes audits to verify that its fiat reserves are adequately maintained to assist its rising crypto ecosystem. Not too long ago, USD Coin has seen a major surge, ascending to grow to be the trade’s second-largest stablecoin and securing a spot among the many prime 10 cryptocurrencies by market capitalization.

USDC Tokens

Regardless of its commendable fame, USD Coin will not be exempt from potential dangers. A notable occasion was when Silicon Valley Financial institution, which held over $3 billion in USD Coin, collapsed, resulting in a major de-pegging of USDC, which noticed its worth plummet to as little as $0.86.

This collection of financial institution failures additionally included the collapse of Signature Financial institution, ensuing within the discontinuation of its product, Signet, which was instrumental within the redemption of USDC for US {dollars}. This occasion forged a shadow over Circle and USD Coin, elevating questions concerning the stablecoin’s means to resist a disaster.

Nonetheless, USD Coin demonstrated its resilience by shortly recovering from this setback and restoring its peg shortly after the preliminary divergence.

USDT vs USDC: Comparative Evaluation

When it comes to market presence, Tether (USDT) holds a bonus, having been launched in October 2014, 4 years previous to the launch of USD Coin (USDC) in September 2018. Nonetheless, Tether’s journey has been marred by controversies, with critics questioning the adequacy of its reserve disclosures and the sufficiency of its reserves to redeem all circulating USDT tokens.

Conversely, USD Coin has usually maintained a much less controversial profile, though it hasn’t been totally devoid of points. Essentially the most vital incident was the de-pegging occasion in March 2023, as detailed within the de-pegging incidents part above. This occasion rattled the market’s confidence in USDC, resulting in a considerable decline in its market capitalization.

USDC vs USDT: Which Is Higher?

Whether or not you select between USDT and USDC stablecoins, it largely depends upon your meant use. In case your aim is to carry both for a quick interval to facilitate commerce on a crypto change, the selection between the 2 could not considerably affect your determination. Nonetheless, in case you plan to carry USDT or USDC as a retailer of worth over an prolonged interval, there are essential components to think about.

Redemptions: Tether offers a service to transform USDT tokens into USD. Nonetheless, this service might not be sensible for a lot of USDT holders as a result of minimal redemption quantity of 100,000 USDT ($100,000) and a 150 USDT verification payment. Most USDT holders seeking to convert their tokens to fiat will possible resort to a cryptocurrency change. Some exchanges, corresponding to Kraken, supply direct buying and selling pairs like USDT/EUR and USDT/USD. On different platforms, you could must change USDT for a cryptocurrency like BTC earlier than promoting it for fiat.

In distinction, USD Coin affords a extra accessible redemption course of by Circle’s Circle Account product, with a minimal redemption of $100 by way of financial institution wire. Alternatively, you possibly can convert USDC to USD by a cryptocurrency change.

De-pegging Incidents: Each USDT and USDC have skilled de-pegging incidents the place their worth fell beneath the $1 goal.

In October 2018, USDT dropped to as little as $0.92 amid rumors of inadequate backing for USDT and withdrawal points on the Bitfinex cryptocurrency change. Nonetheless, USDT ultimately regained its $1 peg.

USDC skilled a major de-pegging incident in March 2023, following the sudden collapse of the US-based Silicon Valley Financial institution resulting from a financial institution run. $3.3 billion of the reserves backing USDC had been held at this financial institution, resulting in a sell-off of USDC and a drop in its worth beneath $1 on a number of crypto exchanges, in some circumstances as little as $0.91. Nonetheless, USDC shortly recovered to its $1 goal inside a couple of days, with Circle accessing the $3.3 billion reserve deposit at Silicon Valley Financial institution and transferring it to new banking companions.

Longevity: When it comes to market presence, USDT, initially referred to as Realcoin and launched in October 2014, has an extended historical past in comparison with USDC, which was launched in September 2018. Thus, USDT holds a bonus when it comes to longevity.

Liquidity: In comparison with USD Coin, Tether boasts a considerably increased buying and selling and liquidity quantity. As per CoinMarketCap knowledge, Tether’s each day buying and selling quantity hovers round $80 billion, dwarfing USD Coin’s each day buying and selling quantity of roughly $11 billion. This substantial quantity distinction positions Tether because the extra favored stablecoin amongst merchants and buyers.

The Dangers Of Stablecoins

Stablecoins, with their promise of reliability and trustworthiness, have grow to be a cornerstone within the crypto panorama. Nonetheless, the yr 2022 served as a stark reminder of the dangers concerned. The crypto neighborhood witnessed the dramatic collapse of the Terra ecosystem, designed to assist algorithmic stablecoins like UST, and the chapter of the FTX cryptocurrency change.

These occasions, coupled with a collection of bankruptcies within the crypto lending trade, considerably impacted the belief customers place within the crypto trade, significantly in centralized companies the place customers deposit their crypto. Stablecoins like USDC and USDT, which depend on belief, had been no exception. Customers holding these stablecoins belief that the issuers have enough reserves to again each token in circulation.

Alternate options to USDT and USDC

For these in search of alternate options to centralized stablecoins like USDC and USDT, over-collateralized crypto-backed stablecoins, corresponding to DAI, are value contemplating. DAI affords a excessive degree of transparency as it’s backed by a various vary of belongings, together with USDC, and its issuance and redemptions are carried out totally on-chain by good contracts. Nonetheless, customers ought to concentrate on the potential vulnerability of such stablecoins to excessive crypto market actions. One other different following the same centralized mannequin is Binance USD (BUSD), issued by Paxos and managed by the New York State Division of Monetary Companies (NYDFS).

Conclusion

In conclusion, stablecoins play a vital function within the crypto ecosystem, offering a secure worth linked to fiat foreign money. Whereas each Tether and USD Coin goal to keep up a 1:1 worth ratio with the US greenback, they every have their distinctive options and challenges. Tether, with its lengthy historical past and bigger buying and selling quantity, has confronted controversy over its reserve belongings’ stability.

In distinction, USD Coin, regardless of its smaller buying and selling quantity, has been extra clear about its reserve belongings. The selection between the 2 will rely upon particular person wants and preferences. Because the crypto market continues to evolve, the competitors between USDT and USDC will intensify.

Nonetheless, as of 2023, each stay integral to the crypto ecosystem, offering a secure retailer of worth for merchants and buyers. The way forward for stablecoins is promising, and whether or not you select USDT, USDC, or one other stablecoin, understanding the related dangers and advantages is essential.

At all times keep knowledgeable concerning the newest developments within the crypto house to make the perfect choices to your monetary future. Because the crypto market continues to evolve, we will anticipate to see extra stablecoins, every with distinctive options and advantages.

For now, USDT and USDC stay the main contenders within the stablecoin market, providing a novel mixture of stability, liquidity, and trustworthiness, making them invaluable belongings for any crypto investor.

FAQs

What are the primary variations between USDT and USDC?

USDT and USDC are each stablecoins pegged to the US greenback, however they differ when it comes to transparency, liquidity, and controversy. USDT, launched by Tether Ltd., has a bigger buying and selling quantity however has confronted criticism over the transparency of its reserves. Then again, USDC, launched by the Centre Consortium, has been extra clear about its reserves however has a smaller buying and selling quantity.

Why is USDT used greater than USDC?

USDT has been out there longer than USDC, which has contributed to its wider acceptance and bigger buying and selling quantity. Moreover, USDT is listed on extra exchanges and is commonly the default stablecoin for a lot of merchants and buyers resulting from its excessive liquidity.

Are USDT and USDC secure to make use of?

Each USDT and USDC are usually thought-about secure to make use of, however they arrive with their very own dangers. It is necessary for customers to grasp that whereas these stablecoins are pegged to the US greenback, they don’t seem to be proof against market dangers and regulatory scrutiny

How are USDT and USDC backed?

Each USDT and USDC declare to be backed by reserves held by their respective issuers. USDT’s reserves embrace conventional foreign money and money equivalents, whereas USDC’s reserves are held in US {dollars} in segregated accounts.

Can USDT and USDC be redeemed for US {dollars}?

Sure, each USDT and USDC could be redeemed for US {dollars}. Nonetheless, the method and circumstances for redemption differ. Tether requires a minimal of 100,000 USDT for direct redemption, whereas Circle permits for USDC to USD redemption with a minimal of $100.