adventtr

Once I last covered BIT Mining Restricted (NYSE:BTCM) in early September, it was simply days earlier than the lengthy awaited transition of Ethereum (ETH-USD) from a Proof of Work to Proof of Stake consensus mechanism. In my article, I cautioned that 76% BIT Mining’s self-mined crypto income got here from Ethereum mining – income that may go away following the consensus mechanism change. After “The Merge” final September, BIT Mining Restricted has needed to regulate its self-mining method. On this replace, we’ll take a look at the present standing of BIT Mining’s income segments and stability sheet following Q1 earnings.

Full Income Image

Complete Q1 income for BIT Mining Restricted got here in at $72.9 million. Whereas that is up 19% over This fall, the corporate’s Q1 efficiency represents a dramatic 75% decline in income 12 months over 12 months. This is not essentially distinctive to BIT Mining Restricted as many crypto-related firms have seen drastic income declines over the past 12 months or so.

BIT Mining goals to have a diversified income era mannequin that features mining swimming pools, datacenter companies, and miner manufacturing along with the corporate’s self-mining phase. As anticipated final 12 months, the self-mining portion of the income fell aside following The Merge falling from $7.1 million in Q3-22 to simply $1.9 million the next quarter. On the finish of Q1, crypto self-mining income got here in at $6.2 million. This was up 226.3% sequentially however down practically 73% from the year-over-year comp.

| Income from: | Q1-22 | Q2-22 | Q3-22 | This fall-22 | Q1-23 | QoQ | YoY |

|---|---|---|---|---|---|---|---|

| Self-mining | $22.9 | $14.8 | $7.1 | $1.9 | $6.2 | 226.3% | -72.9% |

| Mining Pool | $272.3 | $178.5 | $88.5 | $53.9 | $60.0 | 11.3% | -78.0% |

| Datacenter Companies | $1.5 | $2.2 | $1.4 | $5.2 | $5.9 | 13.5% | 293.3% |

Supply: BIT Mining Restricted, thousands and thousands

Manufacturing income is a distant 4th place when it comes to income phase rank and seems to have solely accounted for $0.8 million up to now. As of final quarter, datacenter companies are the one significant space of development for the corporate and it is a small share of income for the general enterprise. BIT Restricted remains to be extremely reliant on mining pool income because it makes up over 82% of the corporate’s whole determine. Although it needs to be famous that the corporate has diminished its reliance on mining pool income from 92% in Q1-22.

Along with shedding the ETH mining income final 12 months, the corporate additionally cited declines in crypto market costs as a trigger for the discount in crypto mining income as properly. As a result of failing economics of the enterprise, BIT Mining made the choice to droop sure kinds of BTC mining rigs. For the quarter ended March thirty first, BTCM was solely in a position to mine 99 BTC with acknowledged income of $2.1 million. Nearly all of the corporate’s mining income now comes from mining Dogecoin (DOGE-USD) and Litecoin (LTC-USD).

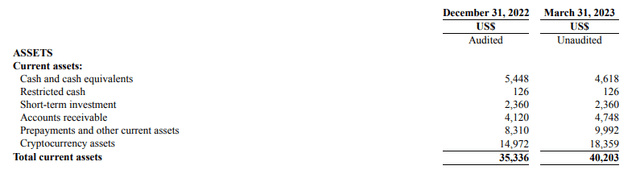

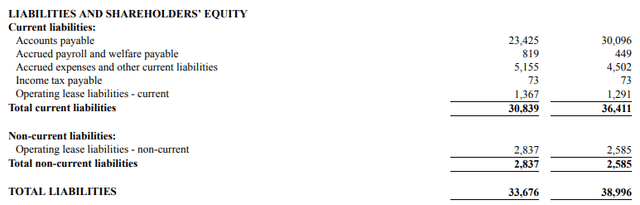

Steadiness Sheet

On the finish of March, BIT Mining Restricted had $40.2 million in present belongings. This was up from $35.3 million on the finish of 2022; nevertheless, nearly all of that $4.9 million improve is from a $3.4 million revaluation within the firm’s cryptocurrency holdings. Money declined from $5.4 million on the finish of 2022 to $4.6 million on the finish of March:

BIT Mining Restricted

There was a little bit of a rotation within the make-up of the crypto holdings as properly. The corporate’s crypto treasury is comprised of Bitcoin (BTC-USD), ETH, and DOGE:

| Holdings | This fall-22 | Q1-23 | QoQ |

|---|---|---|---|

| BTC | 289 | 289 | 0.0% |

| ETH | 4,845 | 3,243 | -33.1% |

| DOGE | 42,800,000 | 69,500,000 | 62.4% |

Supply: BIT Mining Restricted

Quarter over quarter, the corporate did not see any change within the BTC on the stability sheet. Nonetheless, it did promote 1,602 ETH and grew DOGE holdings by practically 27 million DOGE. This implies roughly $5 million of BIT Mining Restricted’s $18 million in crypto holdings are allotted to a meme coin. The larger head-scratcher although could be the choice to promote ETH when it’s the solely coin the corporate holds that may generate returns by means of staking.

BIT Mining Restricted

From a legal responsibility standpoint, BIT Mining Restricted cites $36 million in present liabilities and $39 million in whole liabilities when including lease obligations. Quarter over quarter shares excellent grew just a little over 4%.

Dangers

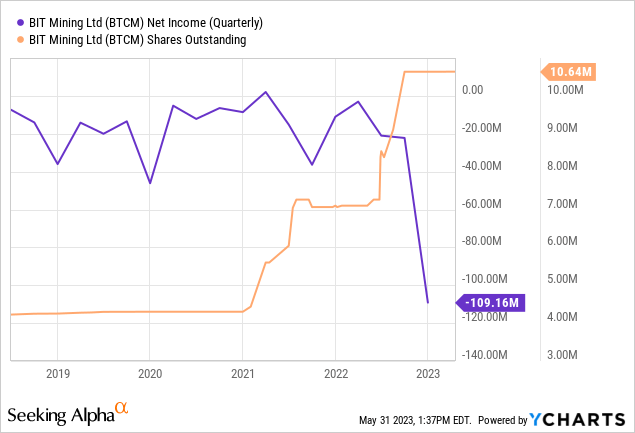

There is not way more data within the firm’s filings pertaining to legal responsibility particulars. We all know BIT Mining Restricted beforehand operated a lottery enterprise earlier than coming into crypto mining in 2021. We additionally know the corporate has precisely one quarter of optimistic web earnings between 2016 and 2022:

This isn’t an organization that has a historical past of producing optimistic earnings even when crypto was at all-time highs. Share dilution stays an ongoing concern.

Abstract

BIT Mining Restricted’s mining pool and self-mining companies are telling the story. The broader development for these segments is in decline. The chance in datacenters is fascinating, however there can be fairly a little bit of competition in that area. Earlier in Could, BIT Mining Restricted announced a partnership with an organization known as Chain Response to producing BTC mining programs with a brand new ASIC chip that the businesses describe as “groundbreaking.” Although there have been no specifics about manufacturing models and gross sales supplied.

Moreover, the corporate’s crypto treasury administration selections are odd from the place I sit. Whereas I’ve made it no secret that I feel belongings like Dogecoin haven’t got a lot a future, in my opinion the extra egregious choice is promoting the ETH on the stability sheet when the corporate might be producing rewards by staking it natively on-chain. It is obscure why administration would choose as an alternative for holding meme cash slightly than promoting all DOGE manufacturing and staking Ethereum at nearly no price. BTCM remains to be an keep away from for me.

Editor’s Observe: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.