On-chain knowledge suggests a majority of the Bitcoin change inflows are at present coming from traders holding their cash at a loss.

Bitcoin Trade Influx Quantity Is Tending In the direction of Losses Proper Now

Based on knowledge from the on-chain analytics agency Glassnode, the short-term holders are principally contributing to those loss inflows. The “exchange inflow” is an indicator that measures the entire quantity of Bitcoin that’s at present flowing into the wallets of centralized exchanges.

Usually, traders deposit to those platforms every time wish to promote, so a considerable amount of inflows is usually a signal {that a} selloff is happening within the BTC market proper now. Low values of the metric, however, suggest holders might not be collaborating in a lot promoting in the meanwhile, which could be bullish for the worth.

Within the context of the present dialogue, the change influx itself isn’t of relevance; a associated metric referred to as the “change influx quantity revenue/loss bias” is. As this indicator’s title already suggests, it tells us whether or not the inflows going to exchanges are coming from revenue or loss holders at present.

When this metric has a worth better than 1, it means nearly all of the influx quantity accommodates cash that their holders had been carrying at a revenue. Equally, values beneath the brink suggest a dominance of the loss quantity.

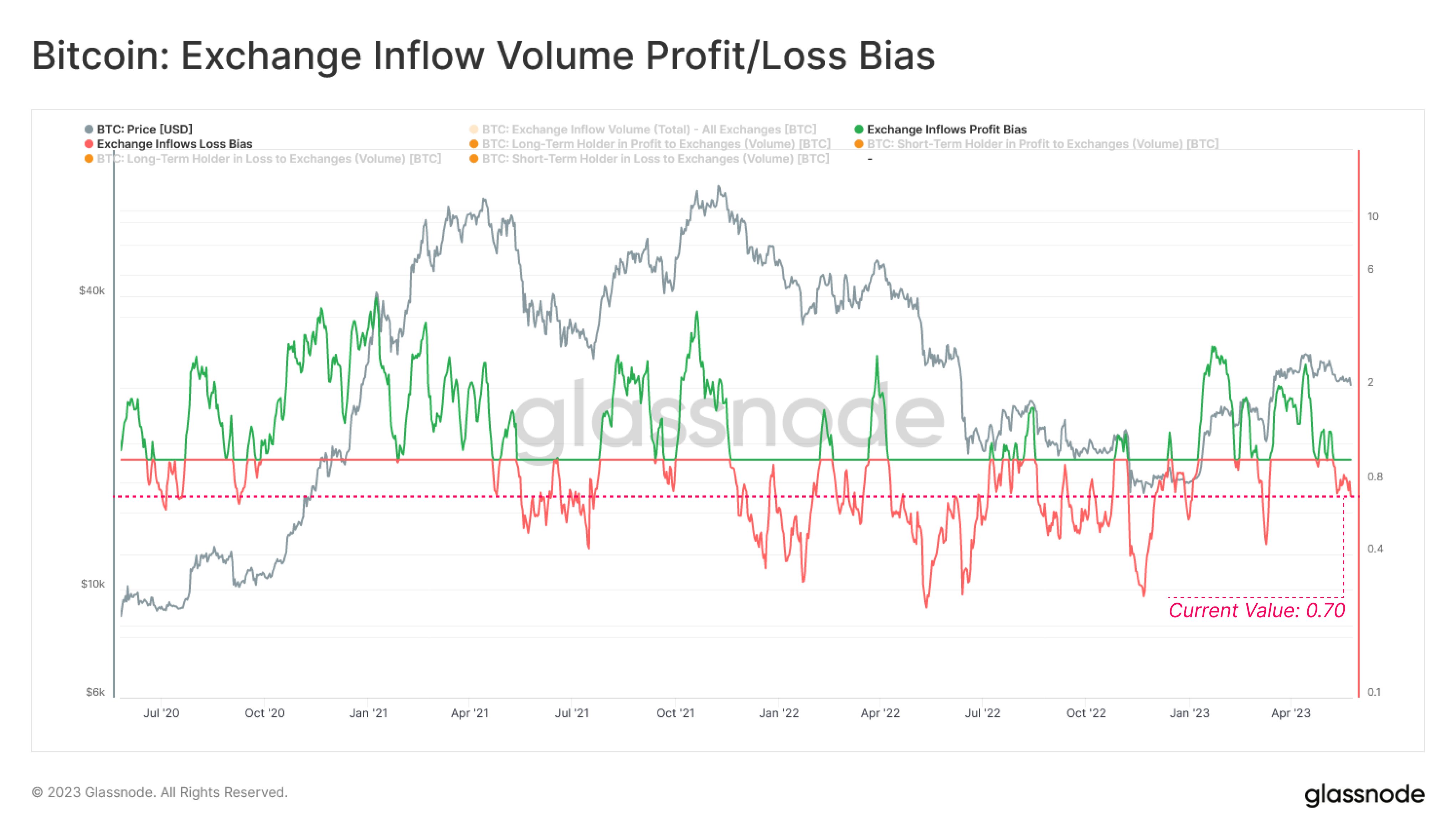

Now, here’s a chart that exhibits the pattern within the Bitcoin change influx revenue/loss bias over the previous few years:

The worth of the metric appears to have noticed some decline in current days | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin change influx quantity revenue/loss bias has had a worth above 1 for a lot of the ongoing rallies that began again in January of this 12 months.

This implies that a lot of the change inflows on this interval have come from the revenue holders. This naturally is sensible, as any rally typically entices numerous holders to promote and harvest their positive factors.

There have been a few distinctive cases, nevertheless. The primary was again in March when the asset’s value plunged beneath the $20,000 stage. The bias out there shifted in the direction of loss promoting then, implying that some traders who purchased across the native high had began capitulating.

An analogous sample has additionally occurred lately, because the cryptocurrency’s value has stumbled beneath the $27,000 stage. Following this plunge, the indicator’s worth has come down to only 0.70.

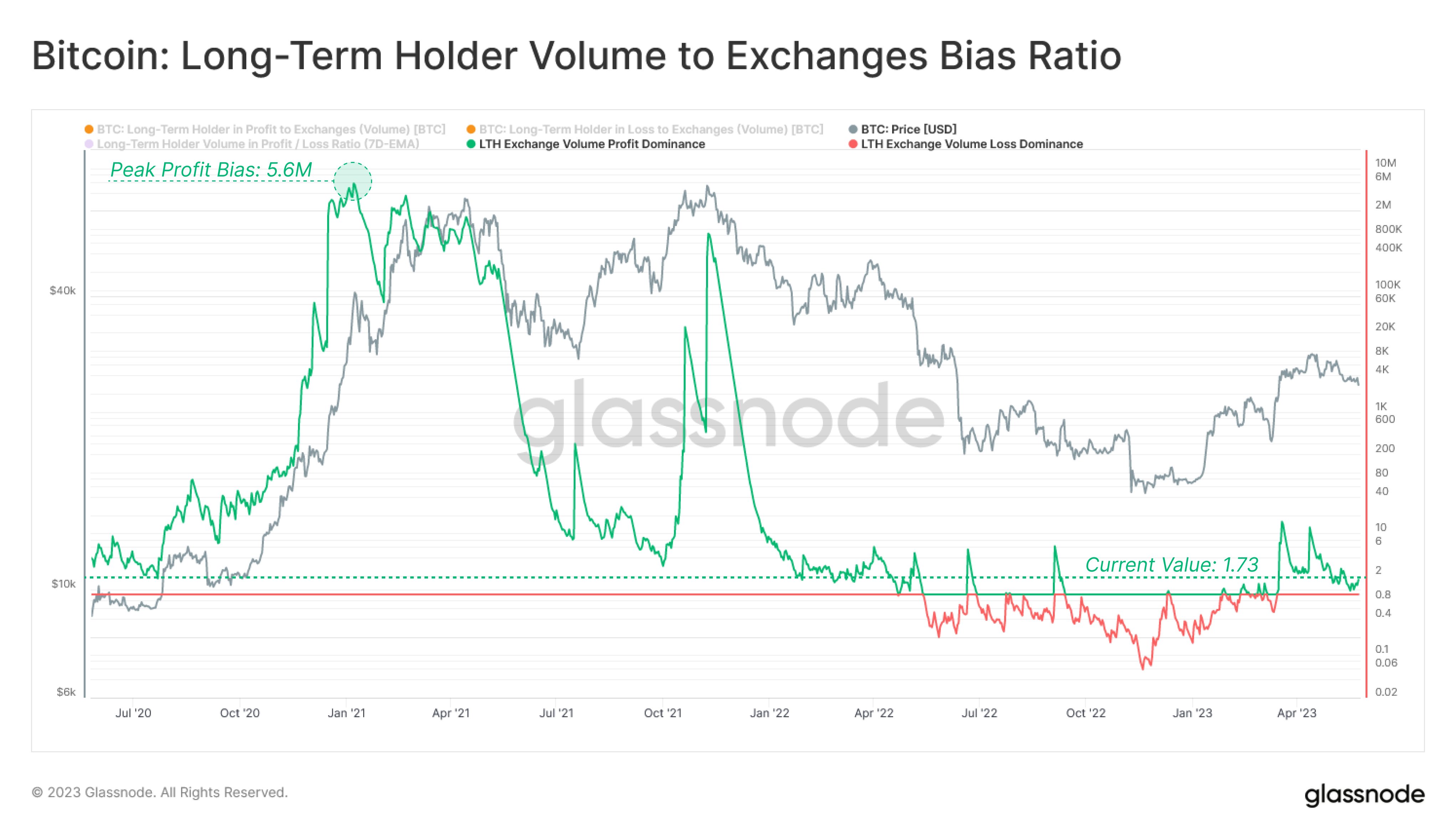

Additional knowledge from Glassnode reveals that the bias of the long-term holders (LTHs), the traders holding their cash since not less than 155 days in the past, have really leaned in the direction of earnings lately.

Seems to be just like the indicator has a optimistic worth proper now | Supply: Glassnode on Twitter

From the chart, it’s seen that the indicator has a worth of 1.73 for the LTHs, implying a powerful bias towards earnings. Naturally, if the LTHs haven’t been promoting at a loss, the other cohort should be the short-term holders (STHs).

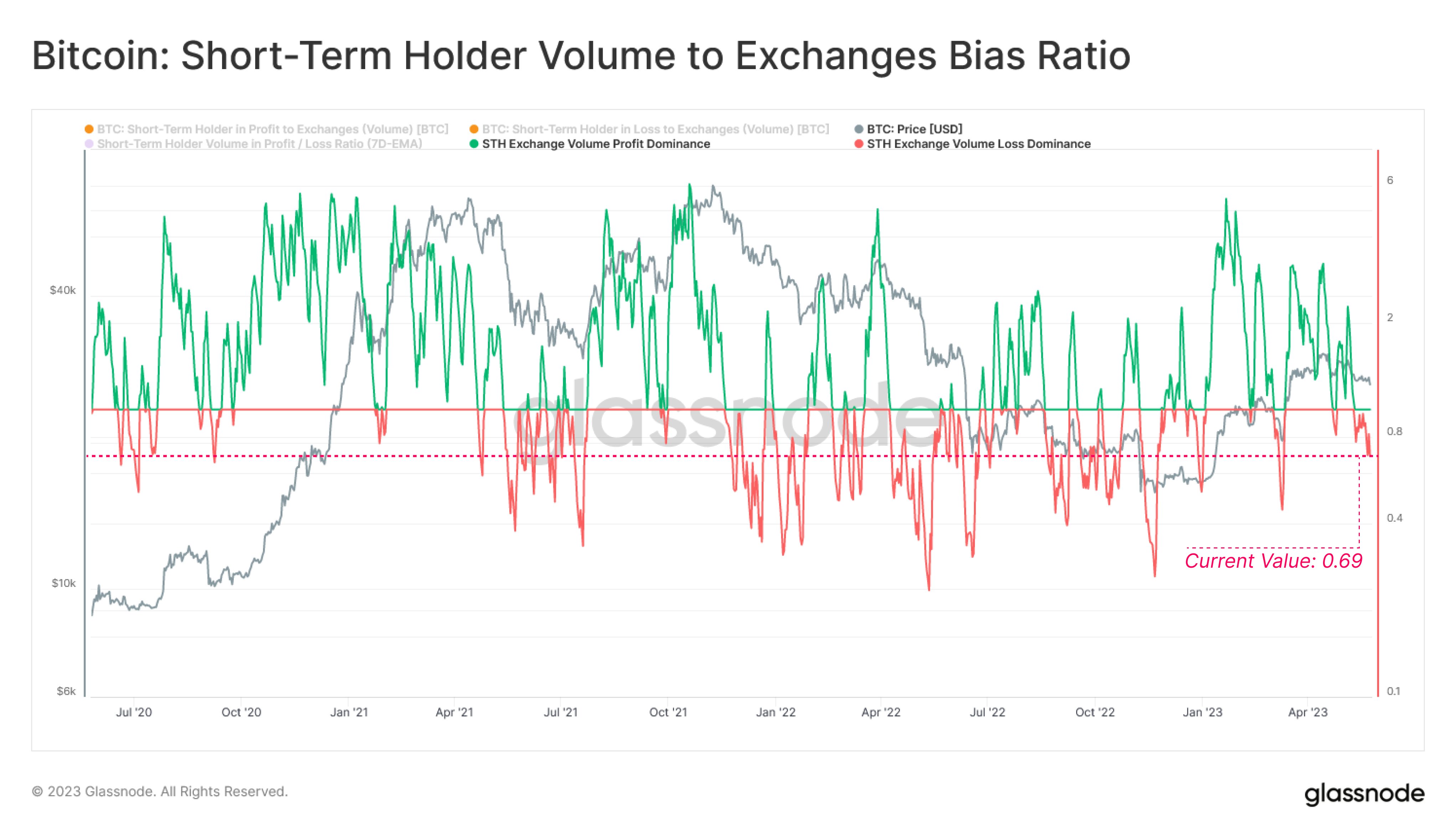

This group appears to have a heavy loss bias at present | Supply: Glassnode on Twitter

Curiously, the indicator’s worth for the STHs is 0.69, which is sort of precisely the identical as the typical for your complete market. This could imply that the LTHs have contributed comparatively little to promoting stress lately.

The STHs promoting proper now could be those that purchased at and close to the highest of the rally to this point and their capitulation could also be an indication that these weak palms are at present being cleansed from the market.

Though the indicator hasn’t dipped as little as in March but, this capitulation might be an indication {that a} native backside could also be close to for Bitcoin.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,400, down 1% within the final week.

BTC has struggled lately | Supply: BTCUSD on TradingView

Featured picture from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, Glassnode.com